Inverted Yield Curve

пятница 01 маяadmin

Inverted Yield Curve Rating: 5,5/10 8179 reviews

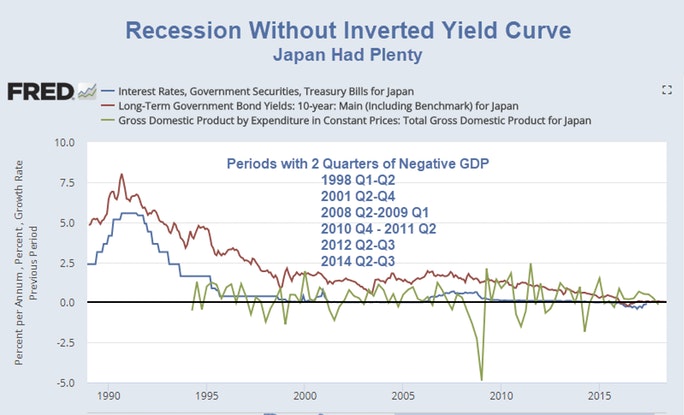

A in which the long-term on are lower than short-term yields. A trends upward because expect a larger for a longer; however, if a yield curve turns negative, it indicates that the believes that for long-term is increasing or will increase, which will drive yields downward. Higher demand for bonds usually occurs when investors believe that will fall. As a result, an inverted yield curve is a highly and indeed is seen as a predictor of a coming. An inverted yield curve is the rarest yield curve. It is also called a negative yield curve. Best fps io games.

.1559146165005.png)

NEW YORK - A dramatic rally in Treasuries this week led some key parts of the U.S. Yield curve to reinvert, a signal that has traditionally been.

Inverted yield curve.